The Shape of the Economy

Hello, I hope that the summer is ending on a high for you and yours.

The economy has been showing signs of slowing recently. How is it going? It depends on where you’re situated.

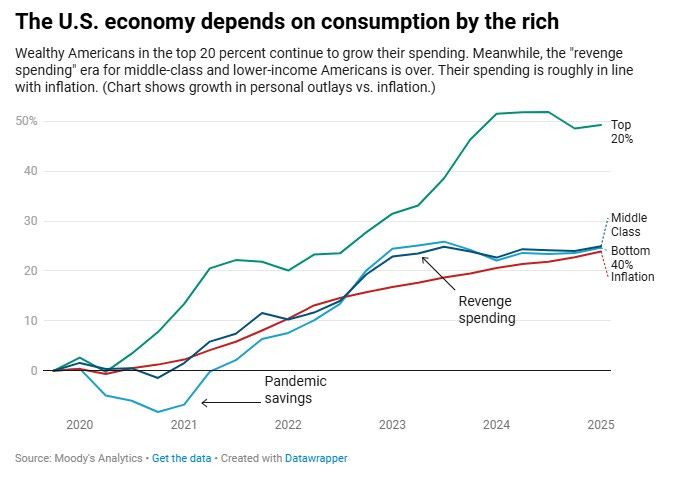

Heather Long, an economics reporter, recently posted this graph of consumption patterns in the U.S.:

As you can see, spending among the bottom 80% of the U.S. by income has pulled back; most Americans are now increasing spending at more or less the same rate as inflation. The top 20% though, has been largely resilient up until now and continues to spend. This is forming “The K-Shaped Economy” as you have different groups behaving differently, forming a visible ‘K’ in the graph above as one group goes up and the other goes down.

What can you say about the top 20% of Americans by income? They’re older. They tend to hold stock and investments. They likely own a home and maybe other real estate. They rely less upon their job for income, or their job might be resistant to shocks (e.g., an orthodontist or eye doctor). Meanwhile, their stock holdings and home value have appreciated meaningfully, so they may feel pretty flush.

The bottom 80% of course describes the vast majority of Americans. Most are struggling and essentially live paycheck-to-paycheck. Job security is getting tougher and tougher, and losing their job is an enormous blow if it does happen. I recently heard of a major company pushing over a thousand employees into early retirement - a friend was among those laid off. Meanwhile, most Americans’ costs have been creeping up relentlessly, and will go up again as the Trump tariffs are fully implemented. Young people are faced with a job market that is already being transformed by AI. A recent stat said that 70-year olds are now more likely to be buying a house than 35-year olds. That’s not what you want to see.

Signs are mounting that the water is getting rough. Loan delinquency levels are rising and consumer confidence is weakening. Visitors to Las Vegas dropped 11.3% in June, among both domestic and foreign travelers. Foreign tourists, particularly Canadians, are visiting the U.S. less, which will result in $12.5 billion less spending in New York City, California, Vegas and other destinations this year, another result of Trump’s trade war.

Where will it go from here? I’m pessimistic about the real economy as experienced by most people, as I think the pressures are set to increase, including AI-fueled layoffs and workers quietly not being replaced, as well as companies passing along tariffs in the form of higher prices.

The stock market has been frothy for a while now, but corporate efficiencies are set to spike so it’s hard to say what’s to come. I’ve spoken to numerous insiders who say their profitability will go up as their headcount goes down. We’re witnessing a trillion dollar investment in AI and data centers by various tech companies whose valuations are being rewarded by investors the more they spend. What’s bad for workers may be good for shareholders, and the economy and the stock market may walk different paths.

This is fundamentally the theme of the K-Shaped economy - the economy is diverging along various lines depending on where you’re sitting. The winner-take-all economy is becoming all the more extreme as AI supercharges the power and importance of having the most capital, data and processing power. The scale of some of these changes is beyond the ability of most people to comprehend. I was recently at an AI conference and the computer scientist Geoffrey Hinton suggested that AI is certain to dominate our lives, so the goal should be to give it maternal instincts so that it wants to look after us. Yikes. At the same conference, I argued that we may be nearing a point where there is more than enough to go around – a point of abundance - as AI ratchets up productivity and innovation and grows the economy. GDP per capita is at $85k per head and set to rise. We could do big things for people as we leave scarcity behind.

One thing I used to point out to the wealthy among us when I was running for President is that satisfaction levels are higher in a more equal society regardless of where you are on the curve. It’s no fun being in a vastly unequal society. What good is abundance if most people are experiencing the opposite?

Can the upcoming abundance be shared? We are a very long way away from that right now.

To see what Forward is doing in your area, click here. For my interview with David Jolly who is running for Governor of Florida, click here. The next Offline Party is in New York on September 18th. I’m working on something that will hopefully get more buying power into people’s hands. Look up.

You’ve nailed the contradiction of this moment: we are approaching a world of technological abundance while living inside a system designed for scarcity. The K-shaped split isn’t new, but AI is accelerating it. Capital-rich firms and the top quintile can reap productivity gains, while the majority are squeezed by job precarity, tariffs, and rising costs.

What worries me most is that we’re normalizing divergence as if it were inevitable. Abundance without distribution is just another form of scarcity. Wealth from AI is guaranteed. What’s not guaranteed is fairness. Without deliberate engagement, the extant inequality will persist, and we’ll find ourselves subjects of post-state sovereigns.

The mindset is the same mindset as those AAA game development studios. And their track record being what they have been should to any sensible society lead to some important reflections and a change to company policy. However, the too big to fail model has become pervasive throughout the world, not just here in the US but I would say a lot of other places too. Those who create amazing gaming platforms through their hard work, blood, sweat and tears seem to perpetually not be rewarded but instead are blamed by the leadership for their failure. Forget that direction when it comes to marketing and execution matter too. Those coders learn the lesson, it is never the boss's fault and those who are weak deserve to suffer. Previously enthusiastic coders with a passion for gaming start out motivated but end up becoming self-hating hollowed out robots inside. When a game starts losing the free to play wonderland, it starts to become a corporate greed revenant of its former self. It starts to become a buyers beware world of whales eating whales and the regulars only small fish fry in an increasingly less populated 'pond' full of only the increasingly hungry and vicious. Any economy that is built on a form of fiat currency seems to run into this same sort of trend. When the average human no longer wants to populate servers because they can no longer afford to play... will listening to enslaved machines with no ability to ask for a vacation or maternity leave really solve your long-term problems? In China they are getting so desperate some bros are looking into making human producing robots now. Well in that case, I suppose we better somehow hope the machines created appreciate your average poor, befuddled and lonely coder more than your typical oligarch? Otherwise, how doomed will our species be? Heck, I'd be worried if I've been a bad boss starting today...